How to Grow your Small Business with SBA Services

The importance of the growth of local businesses in the community can not be taken lightly as it contributes immensely to the economic development of the community and many countries are now focusing more on the small and medium scale enterprises.

Local businesses actually create more jobs that are accessible to both the skilled and the unskilled, play more roles in providing employment, and contributing to the country’s Gross Domestic Products ( GDP).

However, Starting a business can be complicated and time-consuming.

If you’re starting a small business from scratch, you need to have solid business plans.

Also, you should follow the proper steps, get good backup funds as you may need to make several diverse decisions, make mistakes, and know what works better.

Fortunately, small business administration (SBA) services can help you navigate unfamiliar territory and can provide you with opportunities for growth and expansion.

You’ll have a better format to adopt or follow some existing templates of successful businesses.

SBA offers professional business plan writing services and much more.

The purpose of the small business administration and the four primary areas of assistance which the SBA offers are

- Business financing

- Entrepreneurial development by providing education

- Business information, training

- Technical assistance

- Procurement and advocacy

Here are a few services the Small Business Administration offers:

Business Planning Services

The foundation of a successful business is solid planning.

You get consulting service from SBA and you’ll be enlightened on what needs to be in a business plan, how to go about small business administration etc.

Before a small business owner opens a bank account, seeks funding, or even rents a location, plans need to have been made.

The U.S. Small Business Administration provides resources to assist small business owners in developing a business plan, conducting market research, determining startup costs, and planning for funding.

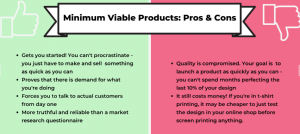

You likely have a rough business plan in your head. You know what you want to sell or you have an understanding of the services you wish to provide.

You might even have a firm grasp of the market. All of this is a great place to start, but your investors and loan providers will want a bit more.

Conducting market research helps to provide metrics and evidence of the need for your project or service and its future potential.

Market research can take the form of surveys, focus groups, and interviews.

Once you have conducted market research you will have a better idea of the demographic most in need of your services or product.

This can guide you in making informed decisions about your business’ location, the number of employees you might need, and whether or not the market is saturated.

On its site, the Small Business Administration provides information on free sources of market information.

Using these tools, you can outline your business’ marketing plan, determine how much it can grow, and within what timeframe.

You can even determine if the plan you have in your head holds up to real-world analysis.

If it doesn’t then you can fine-tune your plan and direction without wasting a dime. For more, you can search for SBA local offices near you

Starting Your Business

A start-up requires a bit of warming up before it hits the track.

You will consider the best business structure for your enterprise and choose a location that is beneficial in terms of taxes and regulations.

You will have to register your business and apply for permits. Inquire about licenses and permits needed to start the business as there are different types and the requirements vary from state to state in the US.

Some states in the US like Florida, Texas, Washington, Georgia, California, Tennessee, etc require one type of license and permit and the other. It usually costs between $50 and $400.

For you to get states that require it and what is needed, we’ll cover that in our next article.

You will also have to receive tax identification at both the federal and local levels.

This is probably the most daunting phase of starting a business, especially for those with little experience in small business ownership.

The U.S. Small Business Administration offers free business counseling through partnerships with organizations like Women’s Business Centers and Small Business Development Centers and others.

Since many small businesses are bound by state and municipal level regulations and laws, choosing a business counselor in your geographic region is beneficial.

Growing Your Business

The day you open your doors is the day your business starts growing. How far and how fast you grow your business is up to you, but knowing your options is key.

Once your business model is working for you and operations are going smoothly, what’s good is to scale the business strategy fast and expand, however, you need to ensure you’ll be able to manage the business well after growth.

The Small Business Administration provides services to help you scale your business without going bust.

Some of those services include basic management services to help streamline existing operations.

Assistance with managing finances, hiring employees, buying additional equipment, securing new assets, and preparing for emergencies are a few of the support areas offered by the SBA.

Once your growth is stabilized you might choose to expand your number of business locations, gain additional funding, or acquire your competitor.

The Small Business Administration offers services and guides for accomplishing those goals.

Whether you are just starting out or revamping an existing business, the Small Business Administration offers services and information for small business owners in search of success.

Signature

Christopher is an author who is passionate about helping local communities and supporting small businesses while working with the Cherokee Nation small business administration services (SBA) in Oklahoma.