A-Z guide for Small & Medium Scale Businesses to get Loans

Business loans are a necessity nowadays with the market which has a high reach for the customers.

For you to get your business on the top, you need to come up with some innovative thing that can help you to make the right amount of money throughout the day.

There are so many people out there that are offering loans for Young Entrepreneurs, and they are all giving out small credits for the startups to make a name for them in the market.

The beginning of startups needs you to be attentive, and there will be so many things that you will get to see when guiding your own business.

However, if you are thinking of something innovative that can help you and your people of the nation or even worldwide then this is what you need to know.

There are many startups that you can see are now one of the top leading brands in the market.

The new ideas and new minds are on hype, and they should be given a chance.

You should not feel de-motivated, and you should work harder after your failures.

These things will surely help you out in the best way possible.

Eligibility for Business Loans for Entrepreneurs

A lender will check many things before you get the loan and here are all the things that you need to keep track of. Let us get started –

Age Limit

One should be 21 years old and should not be more than 65 years of age to get the loan. You need to consider this, and if you are the one with the idea, you need to meet the age requirements.

Collateral

You need collateral for the loan and the guarantee is an immovable property that will be handled by the lender as a point of trust. It is just for the security to approve your loan by the banks.

Don’t worry; many other programs are helpful for you in the long run as they don’t require collateral.

3) Business Plan

One should have a business plan for the business, and without that, things might not work out. A business plan has to be elaborated, and when you are out there to apply for the loan, you will be asked to tell the plan.

A healthy business plan and the idea of your business will get the most attention, and you will be given more chances of getting a loan in your hand.

4) Financial Details of Business

The financial details are the plans for your profit and loss that you will go through in your first year of business. This is because you need to pay back the loan as per the days and for that, you need a better plan for all your finances regarding your businesses.

Keep a note of that before you even get started with the business details for your entrepreneur business.

5) Details of Accounts

The accounts that you will need for the loan are the payable account and the receivable account.

One should get the account details for all of these accounts with the statements that will show your limits and your needs as per your bank balance.

Make sure that are the one with the applicant’s name or a valid reason if not.

Audited Financial Statements

The audited and the checked statements from your bank and credit history are what you need for now.

You need the sign of the bank on it with the audited and in the best condition.

Personal Details

A personal detail like your identity proof is required for you to get the loan quickly.

You need to show up any of them as per your account that you have given for receiving payment.

Insurance of the Applicant

Whenever you are out there looking for a loan, you will be asked for the insurance of your applicant.

You needed to have one in case of any hassles that you get into and got unable to pay the loan.

Insurance is a must for you to approve your loan from a bank easily.

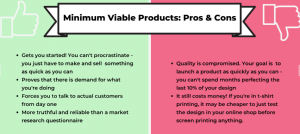

Flaws that you need to Fix in Your Business Startup

Bad and Incomplete Research

Incomplete research can let your business down in seconds. You will see how fast your business drops down and you might have heard of “little knowledge is a dangerous thing.” Well, you need to know more in-depth into the information that is required to get past so many things.

Not Considering Competitors

You need to look after the companies that are giving you tough competition. It is not about being jealous or something, but you need to come up with a unique thing that can help your company to stand up and make the best out of all the money that you got.

It will surely make you think about some new ideas for your competitors to let them down.

Unrealistic Assumptions

Unrealistic assumptions will not take you anywhere. Assumptions are reasonable but not working on them and think about success will only make it fatal for your business.

You need to think about that a little and once you are done with the assumptions that are real enough for your business will surely help you out in the best way.

Neglecting Risks

You should never do that for your own business. If there is a risk with your idea, you need to keep that in your mind, and it will help you to grow your business at a fast pace without any regrets.

Hiding Weakness

Why hide weakness when it is just you? Sometimes it is easier for you to get over such weakness if you want to do something for yourself.

You need to consider the weakness, and as an entrepreneur, you need to work on that to get your business on top of all in the market.

As a budding entrepreneur, you have lots of opportunities for business funding. To stay updated with the available options, you can subscribe to our blog.